ALL IN ONE MEGA PACK - CONSIST OF:

Apartment Acquisition Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

APARTMENT ACQUISITION REAL ESTATE PROFORMA TEMPLATE INFO

Highlights

Five-year Apartment Acquisition pro forma real estate template for startups and entrepreneurs to impress investors and get funded. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the Apartment Acquisition business. Apartment Acquisition private equity waterfall model xls helps you evaluate your startup idea and/or plan a startup costs. Unlocked - edit all.

This well-tested, robust, and powerful Apartment Acquisition financial model for real estate is your solid foundation to plan a Apartment Acquisition business model. Experienced Excel users are free to adjust all sheets as needed, to handle specific business requirements, or to get into greater detail.

Description

This Inventory Control Software Financial Model Excel will help you to:

- Present main economics of an investment opportunity;

- Estimate rates of return and measure NPV for a Apartment Acquisition;

- Measure operating, capital and financing costs;

- Present the cash flow of an investment;

- Perform valuation of an investment property;

- Assess the feasibility of the refinancing option and an amount of taking out;

- Assess a range of rental and exit scenarios;

- Assess a range of financing options.

The contents are as follows:

- Dashboard Tab: flexible acquisition and exit dates, mortgage financing assumptions, re-financing assumptions, acquisition costs, growth rates, and sale costs assumptions.

- The renovation schedule based on the number of units renovated and flexible timing of renovation.

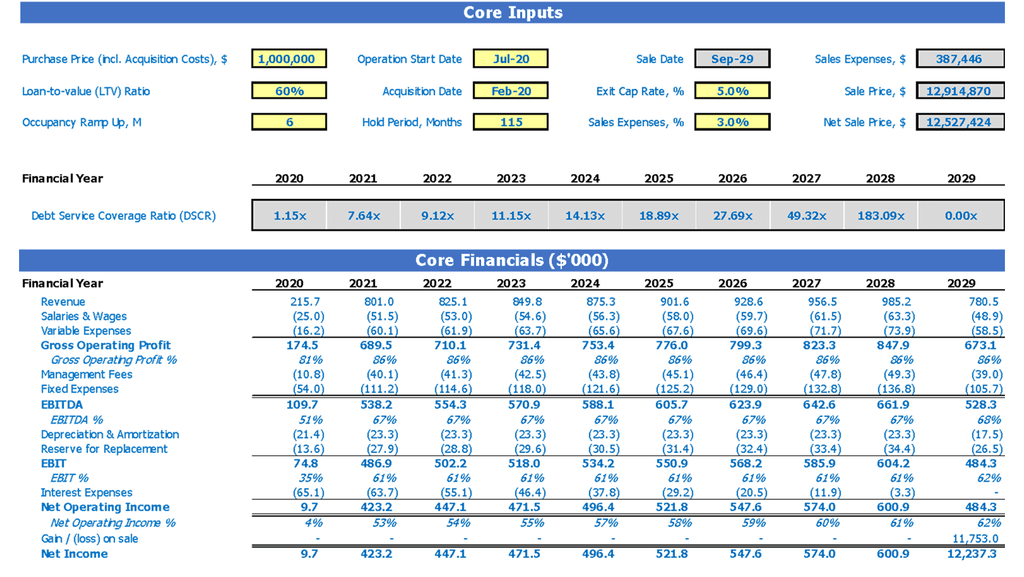

- Equity Waterfall Tab: Includes 10 years of monthly cash flow, costs and revenues, IRR, Equity Multiple, Profit Margin, Net Profit, DSCR, Debt Yield, Operating Margin, Cash on Cash, NPV, DCF.

- Monthly Cash Flow: includes operating revenues, operating costs, NOI, capital costs (leasing fees and CAPEX), debt service, and net income.

- Annual Cash Flow.

- Rent Roll with a flexible number of units. Projection of the operating expenses and additional income.

- Project Financing with senior debt amortization, re-financing option, supplemental loan option, and mezzanine financing.

Key Metrics

- Cost/Square Footage (Sqm), Sale Price/Unit, Net Rental Revenue;

- NOI, Debt Service, Net Leveraged Cash Flow;

- NPV, DCF Valuation;

- DSCR, Cash on Cash Return, IRR, Equity Multiple, Net Profit.

- Exit value for the property is calculated automatically based on NOI for a period and cap rate you assume in your projection.

APARTMENT ACQUISITION REAL ESTATE MODEL REPORTS

All in One Place

This Apartment Acquisition real estate cash flow model is key for investors. You will require the real estate excel model to support how much money you need to start-up with and how much your investor can make on this investment. Remember that investors are not receptive to start-ups that don't have a business plan or a real estate spreadsheets.

Core Inputs

On this tab you can input main assumptions for your business: acquisition date, purchase price, operation start date, hold period, loan-to-value ratio, exit cap rate, sales expenses, occupancy ramp up period, and assumptions for the sensitivity analysis

Equity Waterfall with IRR hardles

Enter equity contributions for the General Partner and Limited Partner as well as 3 IRR hurdles

Property Metrics

NOI & EBITDA

Net Operating Income and EBIDTA chart

Property Inputs

On this tab you can input main property assumptions - unit types, count of units by types, sq. ft. per unit type, occupancy, rent per month per unit, other revenue per month per unit and reserve for replacement per month per unit.

APARTMENT ACQUISITION PRO FORMA EXCEL TEMPLATE REAL ESTATE ADVANTAGES

Land loan with paid-current or accruing interest

NOI based property Exit calculations

Two equity partners with associated 4-tier IRR-based waterfalls (double-promote structure is supported)

NPV, DCF model Valuation

Apartment Annual and Monthly Cash Flow forecasts