ALL IN ONE MEGA PACK - CONSIST OF:

Co Operative Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CO OPERATIVE BANK STARTUP BUDGET INFO

Highlights

Five-year financial model template in Excel for co operative bank with prebuilt three statements - consolidated profit loss statement template excel, balance sheet, and cash flow proforma template. Key financial charts, summaries, metrics, and funding forecasts built-in. Created with the mind of the co operative bank business. co operative bank financial projection helps you evaluate your startup idea and/or plan a startup costs. Unlocked - edit all.

A financial plan for startup specially designed for a startup co operative bank business. Explicitly designed for co operative banks, will not only help you evaluate the financial feasibility of your proposed venture but will also be a valuable tool in selling your project to potential partners, lenders and investors when included in your business plan. The financial model excel template co operative bank will also help you build a financial projection that explains the forecast in sales per month, number of customers and average spending for the co operative bank business.

Description

The co operative bank 3 statement model excel prepared by our team includes a complete financial framework to make solid financial plans and projections. This financial plan for business plan consists of all relevant financial statements and performance metrics, which enable the user to make sound decisions by considering all operational and financial risk factors.

The co operative bank startup costs spreadsheet is highly adaptable and dynamic for forming a 5-year monthly and yearly (projected income statement, projected balance sheet template excel, and excel spreadsheet cash flow) financial projection for a startup or existing co operative bank. This model also consolidates a discounted cash flow valuation calculation by using the projected Free Cash Flows. The co operative bank financial model in excel also calculates the main relevant financial performance ratios and KPIs required by banks and investors to estimate business profitability and liquidity.

One can easily edit our co operative bank financial projection model with basic knowledge of excel and finance by adding information itself. All metrics will be updated automatically after made adjustments in the input sheet. Here you will find all the necessary financial and valuation reports, including business cash flow forecast, break even formula excel, Startup Cost plan, pro forma balance, and the projected income statement. A high-quality 5 year financial projection for an co operative bank makes it possible to foresee a profit for the future to come and enables the user to make wise decisions.

CO OPERATIVE BANK FINANCIAL PLAN REPORTS

All in One Place

This powerful co operative bank financial model in excel allows entrepreneurs to enter assumptions, including costs and income, that can be brought together to show investors their startups' complete financial picture.

Dashboard

Our 5 year cash flow projection template excel has a dashboard that shows important company metrics at various points in time. All data is presented in graphs and charts, and key data includes a breakdown of revenues by year, profit and loss projection, cash flow model excel, and more.

This dashboard simplifies the analysis and prediction process, because all the data is kept in strict order and has high accuracy.

Detailed Financial Statement

You can generate your accounting financial statement using the various assumption provided your bottom up financial model is flexible enough to handle such assumptions and generate statements that are comprehensive and easy to understand, as these are required mostly by investors and lenders.

Sources And Uses Table

The sources and uses statement template in this financial model excel template describes all the funding sources and the spending of these company’s sources.

Break Even Calculation

The break even analysis chart calculation is a part of this financial planning model, because it is critical for any business. This financial indicator is essential, especially for start-ups, to allow them to understand if their chosen business model is one that has a chance to succeed. Startups will be able to consolidate all the financial impacts of their every business decision in this profit loss projection and test if everything could come together and do a profitable business.

The break even chart excel shows the company's required revenue level that will cover all the business costs, including taxes. When this revenue level is reached, the company begins to bring in profits, which means that the start-up investments start to pay off.

Top Revenue

Topline (revenue or gross sales) and bottom line (profit or EBITDA) are key lines on a company's profit and loss forecast template excel. Investors and analysts hone in on a company's revenue and profits. All stakeholders frequently monitor trends in these financial metrics quarterly and annually.

The top line of the profit loss projection refers to a company's revenues or sales. 'Top-line growth' refers to an increase in gross sales or revenue, which in turn will have a positive downstream impact on the company's overall financial performance.

Business Top Expenses List

Top line and bottom line are two of the more common jargon used in Finance. These are also two of the more important numbers in a company's p&l forecast. Investors and analysts pay special attention to these numbers and their respective trends from period to period because they are indicators of a company's potential for success.

The top line of the profit and loss statement format excel refers to the total revenues or gross sales of a company. When the phrase 'top-line growth' is used, it means that the company is experiencing an increase in total revenues. This, in turn, is expected to positively impact the rest of a company's financials and overall performance.

On the other hand, the bottom line refers to the net income. When there is growth in a company's bottom line, it means that there is growth in a company's profitability, net of overhead expenses.

CO OPERATIVE BANK FINANCIAL PROJECTION EXPENSES

Costs

In order to stay on top of your business, you need to stay ahead of cost and expenditure planning, especially start-up costs - an essential component of every co operative bank business plan excel financial template.

All costs, but especially start-up costs, require constant vigilance and vetting; hence our co operative bank p&l template excel has special Pro-forma templates that allow users to quickly and clearly see funding vs. expenditure levels, which help avoid major financial deficits and misallocation. The more you use our co operative bank financial model in excel, the better your results will be.

Development Costs

CapEx start up expenses are the total costs of the company to purchase assets. All of these capex investments have their own time period. As a rule, these are very large expenses. These expenses should be reflected in the projected balance sheet template, because they play a key role in the development of the startup. Almost all CAPEX expenses are aimed at improving and optimizing the company's operations. That is, the company uses these funds to improve the quality of the technology or equipment used. These costs may be reflected in the projected profit and loss statement and also participate in cash flow forecasting tools.

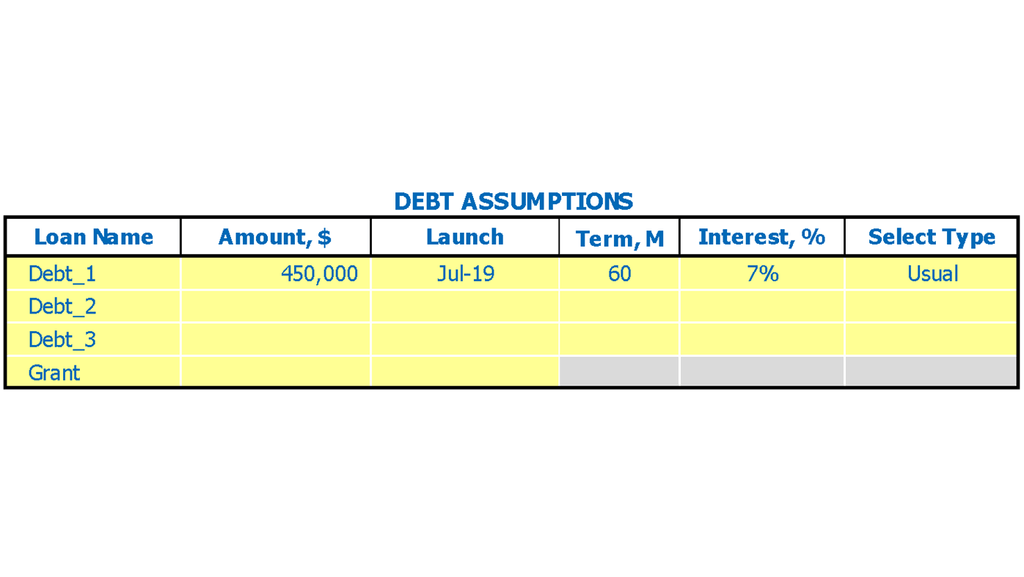

Loan Repayment Schedule

Our business financial model template has a built-in loan amortization schedule with both the principal (i. e. , the amount of loan borrowed) and the interest calculation. A loan amortization schedule template will calculate your company's payment amount, including the information on the principal, interest rate, time length of the loan, and the payments' frequency.

CO OPERATIVE BANK INCOME STATEMENT METRICS

Profitability KPIs

All the performance metrics you need in a single co operative bank feasibility study template excel! It contains pre-built templates to complete your financial reporting templates in excel, including income and expenditure template excel, pro forma balance sheet for a startup business, and cash flow forecast excel.

Use them for your financial planning or presentations to investors. It is up to you! You can easily monitor your company's cash flows, revenues, costs, profitability, and all the important financial ratios and KPI metrics in this co operative bank excel financial model template.

Cash Flow Analysis Template

Because any business's main objective is to produce cash flow, the cash flow forecast is one of the most critical business financial statements. This financial model in excel demonstrates how much money the company has consolidated but not enough to attract more funding.

This sheet also includes a separate page for tracking and analysing your company's cash in and out transactions. This pro forma cash flow statement template is dependent on a number of critical factors, including Payable and Receivable Days, annual revenue, working capital, long-term debt, net cash, and so on. This number is then used to calculate your net cash flow, as well as your initial and ending cash balances. This model is ideal for cash flow management in your firm.

KPI Benchmarking Report

The financial model template for business plan benchmark tab evaluates the effectiveness of a company. Once the company's benchmark is complete, a competitive analysis can be performed. These indicators are important for financial planning, in particular for startups. Competitive analyses can help a company develop their strategy. It is also important to track leading indicators to stay up to date on new industry trends.

Pro Forma Profit And Loss

The monthly profit and loss statement template gives you complete insights into revenue and operating expenses. Since the yearly p&l statement template excel also contains several graphs, assumptions, ratios, margins, good gross profit margin, earning, cost of services, and profit after tax.

Projected Balance Sheet For 5 Years In Excel Format

A balance sheet forecast, also known as the statement of financial position, is a financial report that summarizes an organization’s assets, liabilities, and shareholders’ equity at a specific point in time. This means that the pro forma balance sheet for a startup business presents a list of what the organization owns and owes.

Our startup financial model gives you a ready projected balance sheet template excel template to let you easily evaluate your organization’s status and financial stance.

CO OPERATIVE BANK INCOME STATEMENT VALUATION

Startup Valuation Model

Our co operative bank financial plan template has two integrated valuation methods. It has a discounted cash flow (DCF) and the weighted average cost of capital (WACC) calculations to show a company's forecasted financial performance.

Cap Table Startup

The cap table for startups as a part of business plan excel financial template is a useful tool for start-up companies and early-stage ventures that shows the detailed listing of the company's securities with the breakdown of investors' shares, value, and dilution over time.

CO OPERATIVE BANK STARTUP FINANCIAL MODEL TEMPLATE EXCEL KEY FEATURES

Build your plan and pitch for funding

Impress bankers and investors with a proven, strategic co operative bank pro forma financial statements template excel that impresses every time.

Identify potential shortfalls in cash balances in advance

The co operative bank business projection template works like an 'early warning system.' It is, by far, the most significant reason for a cash flow projection template excel.

Get a Robust, Powerful and Flexible Financial Model

This well-tested, robust and powerful co operative bank excel financial model template is your solid foundation to plan a business model. Advanced users are free to expand and tailor all sheets as desired, to handle specific requirements or to get into greater detail.

Prove You Can Pay Back the Loan You Requested

When you apply for a business loan, bankers will study your cash flow model excel in an attempt to answer this question: Can this business pay back the loan? Requesting a loan without showing your cash flow model template for paying it back is a common way to land in the rejection pile. It is exceptionally accurate if your current cash flow won't cover all of your monthly operating expenses — plus your loan payment. Don't fall into this kind of situation. Use cash flow projection template for business plan to strengthen your case by showing the banker exactly how you plan to use the loan and when you will start repaying the debt. This type of forecasting helps you create a road map that can impress a lender with the confidence they need to approve your loan.

Get it Right the First Time

Funding is a binary event: either you succeed or you fail. If you fail, most investors won’t give you a second chance. Learn about the pros and cons with co operative bank feasibility study template excel.

CO OPERATIVE BANK FINANCIAL MODEL TEMPLATE FOR BUSINESS PLAN ADVANTAGES

Financial Projection Excel Template Predict Cash Shortages And Surpluses

Optimize The Timing Of Accounts Payable And Receivable With 3 way financial model

Create Several Scenarios in co operative bank business revenue model template

Take Control Of The Cash Flow For Your co operative bank

Estimate co operative bank Expenses For Next Periods